[ad_1]

ShinyHunters’ claims surfaced two weeks after Santander Bank acknowledged a data breach linked to a third-party contractor involving data of customers in Spain, Chile, and Uruguay.

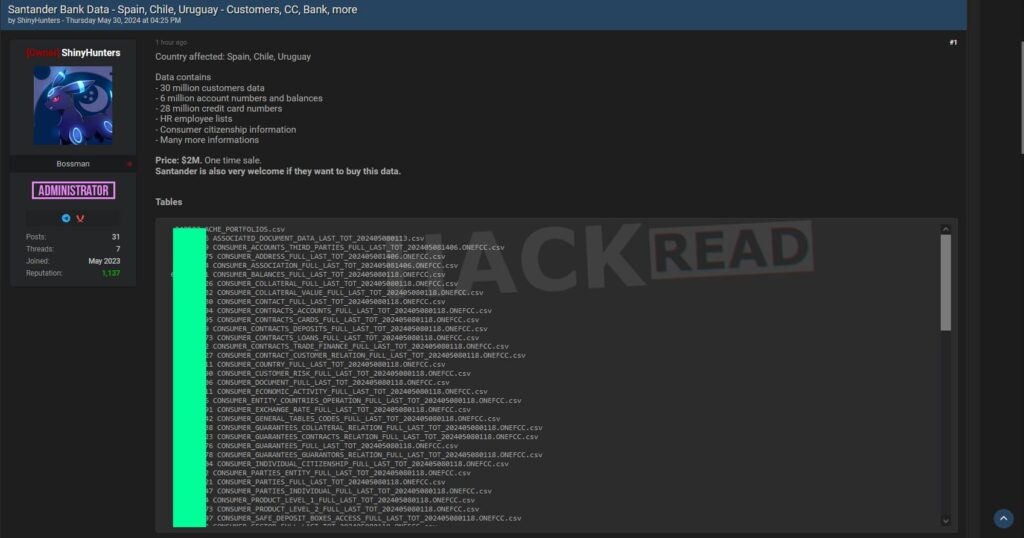

The notorious hacking group ShinyHunters is claiming responsibility for a breach at Santander Bank, a global financial giant. As a result, the personal data of over 30 million customers has been stolen and is currently being sold for a one-time sale price of $2 million.

Santander Bank, a prominent player in the global financial market, operates a network of 8,518 branches worldwide. The alleged breach impacts customers in Spain, Chile, and Uruguay.

Notably, ShinyHunters’ claims surfaced two weeks after Santander Bank acknowledged a data breach linked to a third-party contractor. In a statement (PDF), the bank confirmed that the breach predominantly affected customers in Chile, Spain, and Uruguay, along with several former employees.

ShinyHunters is the same hacker group that claimed responsibility for the recent Ticketmaster-Livenation data breach, where the group allegedly stole 560 million user records, including partial payment card details, just a few days ago.

As seen by hackread.com, the data trove being offered for sale by ShinyHunters contains a wealth of sensitive information, including:

- 30 million customer records

- 6 million account numbers and balances

- HR employee lists

- Consumer citizenship information

- 28 million full credit card numbers, complete with verification details (AVS), and expiration dates (CVV not included)

- And various other sensitive data points

ShinyHunters’ Sophistication and Recent Activities

ShinyHunters is no stranger to the hacking and cybercrime world. The group is known for its high-profile data breaches and is also the owner and administrator of Breach Forums, a notorious platform for cybercrime activities.

Despite the FBI’s recent efforts to shut down the forum, ShinyHunters managed to reclaim the seized domain, showcasing their technical prowess and resilience against law enforcement actions. This, as reported by Hackread.com, not only resulted in the return of Breach Forums to the dark web but also saw its revival on the clearnet, using the original domain.

Will Lin, co-founder and CEO, AKA Identity and Author, The VC Field Guide and former Venture Partner, ForgePoint Capital commented on the breach stating, “This breach is so complicated and simple at the same time. Simple that the attack vector was stolen privileged credentials. ‘Bad actors don’t hack in, they log in.’ Complicated because it involves multiple parties who can only do so much to prevent this from happening.”

“The predicament that the world has today is that credentials have been the number one cause of data breaches since the DBIR started tracking them. The modern world has been set up to fail without good data and visibility into their most important trust boundary: identities and access management,” Lin added.

Advice for Santander Bank Customers

The availability of such a vast amount of sensitive financial information raises serious concerns about the potential for identity theft, fraud, and other illicit activities. This breach highlights the ongoing threats posed by hackers to financial institutions and their customers.

Since Santander Bank has already addressed the issue regarding the breach, customers are urged to monitor their accounts closely for any suspicious activity. Additionally, it is recommended to implement security measures such as two-factor authentication and regularly updating passwords to mitigate the risk of further exploitation by cybercriminals.

RELATED TOPICS

- IntelBroker Hacker Leaks Alleged HSBC & Barclays Bank Data

- Hacker Leaks 73M Records from Indian HDFC Bank Subsidiary

- Infosys Data Breach Impacts 57,000 Bank of America Customers

- World’s Largest Bank ICBC Discloses Crippling Ransomware Attack

- BBTok Malware Returns, Targeting Over 40 Banks in Brazil and Mexico

[ad_2]

Source link