[ad_1]

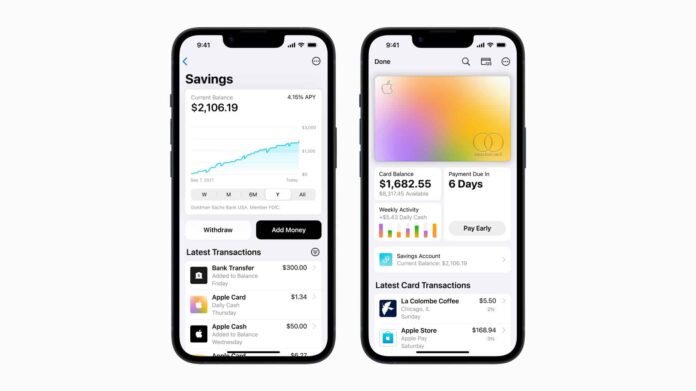

After plenty of rumors, Apple has finally announced the Apple Card Savings Account. It’s available starting today and has an industry-leading 4.15% interest rate – thanks to the Fed.

This is a rather unique service from Apple. As it’s an Apple Card Savings Account. Meaning that it is tied to your Apple Card, and through Goldman Sachs – who backs the card. But this also means you can earn interest on your Daily Cash balance. So all that cash back you get from using that card, now you can earn interest on it. And at 4.15%, that can add up quite quickly.

Of course, this is being treated as a regular savings account, so you can also deposit money into the account yourself.

“Savings helps our users get even more value out of their favorite Apple Card benefit — Daily Cash — while providing them with an easy way to save money every day,” said Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet. “Our goal is to build tools that help users lead healthier financial lives, and building Savings into Apple Card in Wallet enables them to spend, send, and save Daily Cash directly and seamlessly — all from one place.”

How to sign up for the Apple Card Savings Account?

To sign up, simply open the Wallet app on your iOS device. Then tap on the Apple Card. Next tap on the circle with the three dots at the top of the screen and tap on Daily Cash. From there you can select Set Up Savings. And you’ll be walked through the process.

Once you have set it up, your Daily Cash will be automatically deposited into the account and start earning interest.

Apple will still allow users to have Daily Cash added to their Apple Cash balance instead. But this is a really cool feature, that no other credit card is doing right now, but that likely won’t last long.

[ad_2]

Source link