[ad_1]

INTERPOL’s latest assessment on global financial fraud uncovers the sophisticated evolution of cybercrime, fueled by advancements in technology such as Artificial Intelligence (AI), cryptocurrencies, and the proliferation of phishing- and ransomware-as-a-service models.

These developments have made fraud schemes more intricate and accessible to criminals without advanced technical know-how, posing a significant threat to global financial security.

The Rise of Tech-Enabled Fraud

The INTERPOL Global Financial Fraud Assessment points to a worrying trend the use of AI and large language models by organized crime groups to target victims worldwide has become increasingly prevalent.

Combined with the use of cryptocurrencies and the emergence of ‘as-a-service’ business models for phishing and ransomware, this has led to a surge in professional and sophisticated fraud campaigns.

Free Webinar : Mitigating Vulnerability & 0-day Threats

Alert Fatigue that helps no one as security teams need to triage 100s of vulnerabilities.:

- The problem of vulnerability fatigue today

- Difference between CVSS-specific vulnerability vs risk-based vulnerability

- Evaluating vulnerabilities based on the business impact/risk

- Automation to reduce alert fatigue and enhance security posture significantly

AcuRisQ, that helps you to quantify risk accurately:

These campaigns are executed at relatively low costs, making them a preferred method for criminals to defraud individuals and companies on a massive scale.

INTERPOL’s Warning

Jürgen Stock, INTERPOL Secretary General, issued a stark warning during the Financial Fraud Summit in London, emphasizing the epidemic growth of financial fraud.

“We are facing an epidemic in the growth of financial fraud, leading to individuals, often vulnerable people, and companies being defrauded on a massive and global scale,” Stock stated.

He highlighted the urgent need for global cooperation to combat this menace, stressing the importance of closing gaps in international law enforcement and fostering excellent reporting and capacity building to tackle financial crime effectively.

INTERPOL recently released a tweet highlighting the findings of their Global Financial Fraud Assessment report.

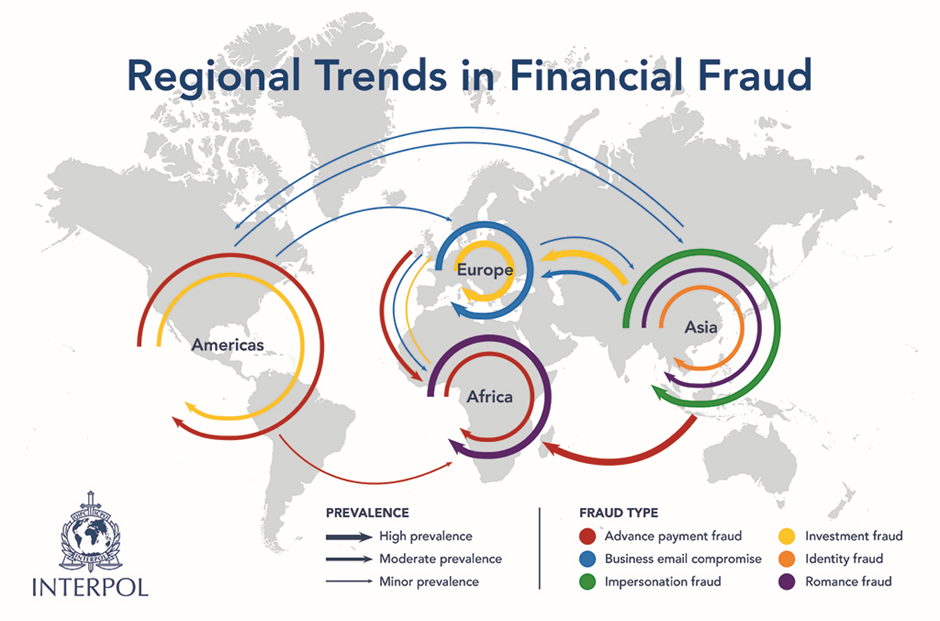

A Closer Look at Regional Trends

Africa: The New Frontier for Email Scams

In Africa, Business Email Compromise (BEC) and ‘pig butchering’ scams are rising, with West and Southern Africa emerging as hotspots.

Criminal groups such as the Black Axe and Supreme Eiye are exploiting online platforms to perpetrate various forms of financial fraud, including romance and investment scams, leveraging their extensive online fraud skills.

Americas: The Hub of Impersonation and Romance Frauds

The Americas are witnessing a surge in impersonation, romance, and tech support frauds.

INTERPOL’s Operation Turquesa V unveiled the grim reality of human trafficking-fueled fraud, with victims being coerced into committing financial crimes, including investment frauds and pig butchering schemes.

Asia: The Birthplace of Pig Butchering Scams

Originating in Asia in 2019, pig butchering scams have flourished, especially during the COVID-19 pandemic.

Criminal organizations in Asia have adopted business-like structures to carry out these scams.

There has also been a rise in telecommunication fraud, where victims are deceived by perpetrators impersonating officials.

Europe: The Epicenter of Online Investment Frauds

Europe has seen a significant increase in online investment fraud and phishing schemes. Criminals target mobile phone apps and employ sophisticated methods to maximize profits.

Pig butchering scams, primarily operated out of Southeast Asia, are also gaining ground in Europe.

INTERPOL’s Call to Action

To combat the escalating threat of financial fraud, INTERPOL emphasizes the need for multi-stakeholder, Public-Private Partnerships to trace and recover funds lost to these crimes.

Since the launch of the Global Rapid Intervention of Payments (I-GRIP) stop-payment mechanism in 2022, INTERPOL has assisted member countries in intercepting over USD 500 million in criminal proceeds, showcasing the potential of international cooperation in fighting cyber-enabled fraud.

As the digital landscape continues to evolve, the fight against financial fraud demands a concerted effort from law enforcement, governments, and the private sector worldwide.

The stakes have never been higher, with billions at risk and the integrity of the global financial system hanging in the balance.

With Perimeter81 malware protection, you can block malware, including Trojans, ransomware, spyware, rootkits, worms, and zero-day exploits. All are incredibly harmful and can wreak havoc on your network.

Stay updated on Cybersecurity news, Whitepapers, and Infographics. Follow us on LinkedIn & Twitter.

[ad_2]

Source link