[ad_1]

First off, Americans were a bit less glued to phones last year. The average daily screen time dipped from 2022’s 4.42 hours to 4.34 hours in 2023. Not a massive drop, but hey, every minute counts in the digital world. For reference, let’s zoom out and go global for a second. In 2023, the world average for daily screen time hit a whopping 5 hours. That’s up 6% from 2022.

Now, let’s dive deeper into the topic and see where all that time went.

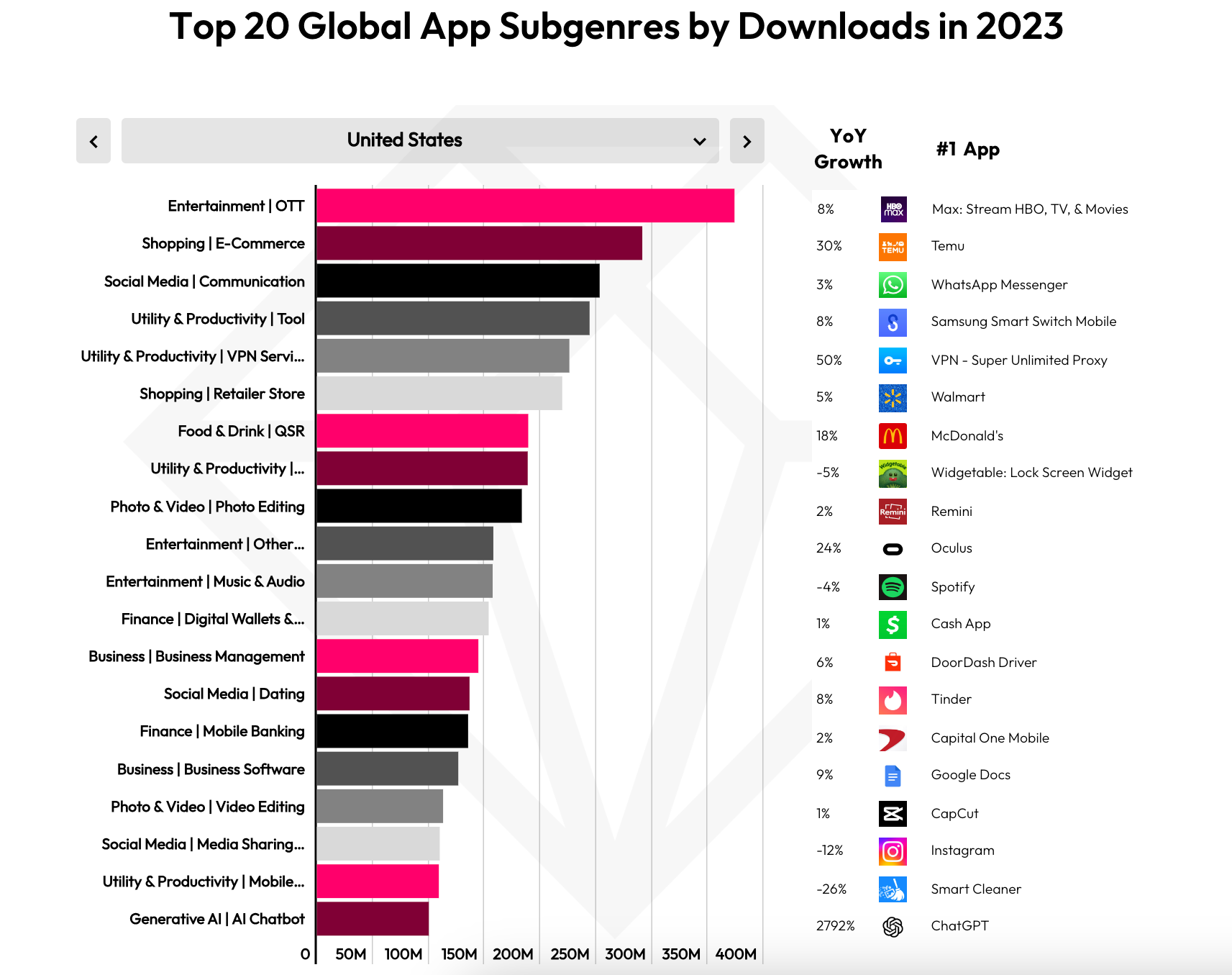

Top app subgenres by downloads in 2023

Image Credit–data.ai

Globally, VPN Service & Web Accelerator apps were the stars, boasting a 42% growth in downloads. But in the US, the scene was quite different. The crown went to HBO’s Max, nestled in the entertainment subgenre. No big shocker there, considering HBO Max 2023 transformation into the revamped streaming service Max, which surely stirred up some download frenzy!But it wasn’t all about streaming shows and movies. The shopping app Temu made some noise in the Shopping and E-Commerce subgenre. And let’s not forget our old pal, WhatsApp Messenger, leading the charge in the Social Media and Communication category with a modest 3% growth.

But the real talk of the town was AI. Despite the Generative AI and AI Chatbot category being at the bottom of the top 20, the ChatGPT app skyrocketed with a 2792% growth. For a newbie app, this might seem standard, but it is quite a success by any measure. Betting on its growth in 2024? You wouldn’t be the only one.

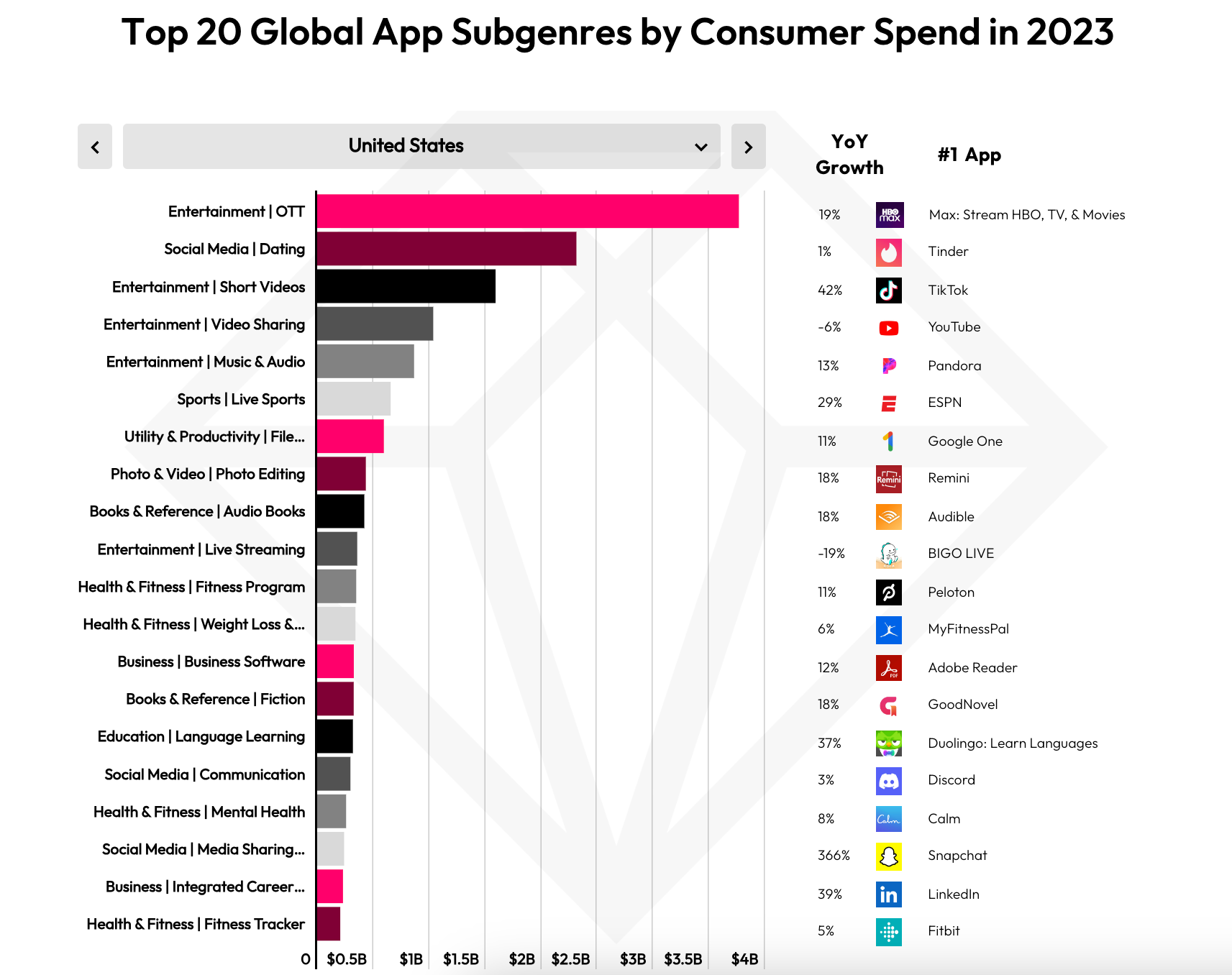

Top app subgenres by money spend in 2023

Image Credit–data.ai

Now, let’s talk about where we threw our dollars. Max tops the charts again. The second place goes to Tinder in the social media| dating subgenre. In the US, Tinder had folks swiping right to the tune of over $2.3 billion, netting a cool 1% growth year-over-year.

Not to be outdone, TikTok users were also opening their wallets, spending more than $1.5 billion on the app. Interestingly, TikTok made history as the first app to reach a whopping $10 billion in total consumer spending.

Meanwhile, Snapchat wasn’t just sitting pretty with filters; its numbers soared last year. While the app might not be leading the pack in overall consumer spending, it is making waves with a staggering 366% year-over-year growth. This impressive leap is largely credited to its newly introduced subscription service.

In 2023, it was all about video in the US consumer spending scene. The Over-the-Top (OTT) subgenre topped the charts, showing us that streaming services are more popular than ever. And it wasn’t just about binge-watching shows; short videos, video sharing, and live sports apps also saw impressive double-digit growth compared to 2022.

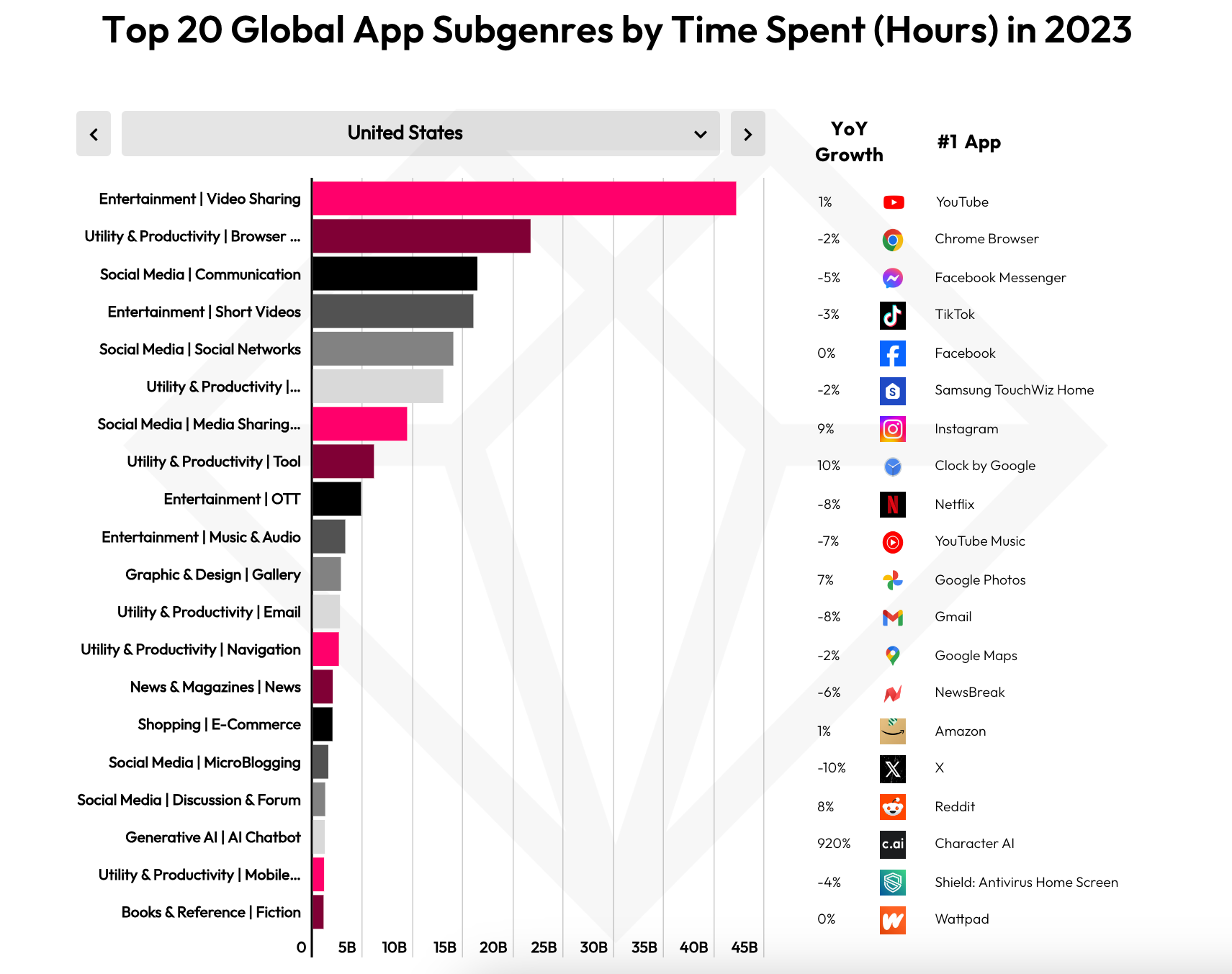

Top app subgenres by time spend in 2023

Image Credit–data.ai

Shifting gears to what might be the most crucial category: the apps where we invest our time. In 2023, four out of the top five subgenres by time spent belonged to Entertainment and Social Media. This is a big deal — these five subgenres alone hogged more than two-thirds of the total time we spent on mobile apps. To give you an idea of the scale, consider this: on Android alone, globally, users spent a mind-blowing 2.3 trillion hours on social media. Moving on.

YouTube, unsurprisingly, clinched the top spot for time spent in 2023. Probably everyone knows what YouTube is, and the numbers indeed, do all the talking. US residents collectively poured more than 40 billion hours into watching YouTube content last year. That is a 1% increase compared to 2022, further cementing YouTube’s place as a favorite go-to for digital entertainment.

In the world of apps, Media Sharing Networks saw the biggest growth spurt in 2023, surging by 35% year-over-year. Leading this charge were popular apps like Instagram and Snapchat. On the other hand, traditional Social Networks didn’t show much change, remaining roughly flat compared to 2022.

There’s also been talk about microblogging platforms, like X (formerly known as Twitter), losing their edge. Despite new entrants like Threads trying to shake things up, the microblogging sector isn’t booming like before. In fact, time spent by US users on X in 2023 dropped by 10% compared to the previous year.

Netflix, also saw an 8% decline in time spent, mirroring the 8% growth of HBO’s Max. Coincidence? I think not. On the flip side, Character.AI in the Generative AI and AI Chatbot subgenre is the app with the most growth. US users spent nearly 2 billion hours creating and chatting with AI characters.

So, what’s the gist? 2023 was a year where we juggled AI, social media, shopping, a bit of romance, and, of course, loads of video content. Quite a year for our mobile apps, right?

[ad_2]

Source link